What Money Do Banks Hold . 1, 2008, the federal reserve began paying interest to banks on these reserves. Consumers approach banks for mortgages, auto loans,. banks make most of their money from loans and fees. banks must hold reserves either as cash in their vaults or as deposits with a federal reserve bank. Bank reserves are the minimum cash reserves that financial institutions must keep in their vaults at any given time. The minimum cash reserve requirements for financial institutions in each country are set by the central bank of that country. Reserves exist to prevent bank runs, which. written by cfi team. the graph shows that banks hold about $75 billion in their vaults at any moment, which translates to about $230. bank reserves refer to the minimum amount of cash banks must keep on hand for liquidity purposes.

from www.bankofengland.co.uk

written by cfi team. banks make most of their money from loans and fees. bank reserves refer to the minimum amount of cash banks must keep on hand for liquidity purposes. Reserves exist to prevent bank runs, which. The minimum cash reserve requirements for financial institutions in each country are set by the central bank of that country. Consumers approach banks for mortgages, auto loans,. the graph shows that banks hold about $75 billion in their vaults at any moment, which translates to about $230. banks must hold reserves either as cash in their vaults or as deposits with a federal reserve bank. 1, 2008, the federal reserve began paying interest to banks on these reserves. Bank reserves are the minimum cash reserves that financial institutions must keep in their vaults at any given time.

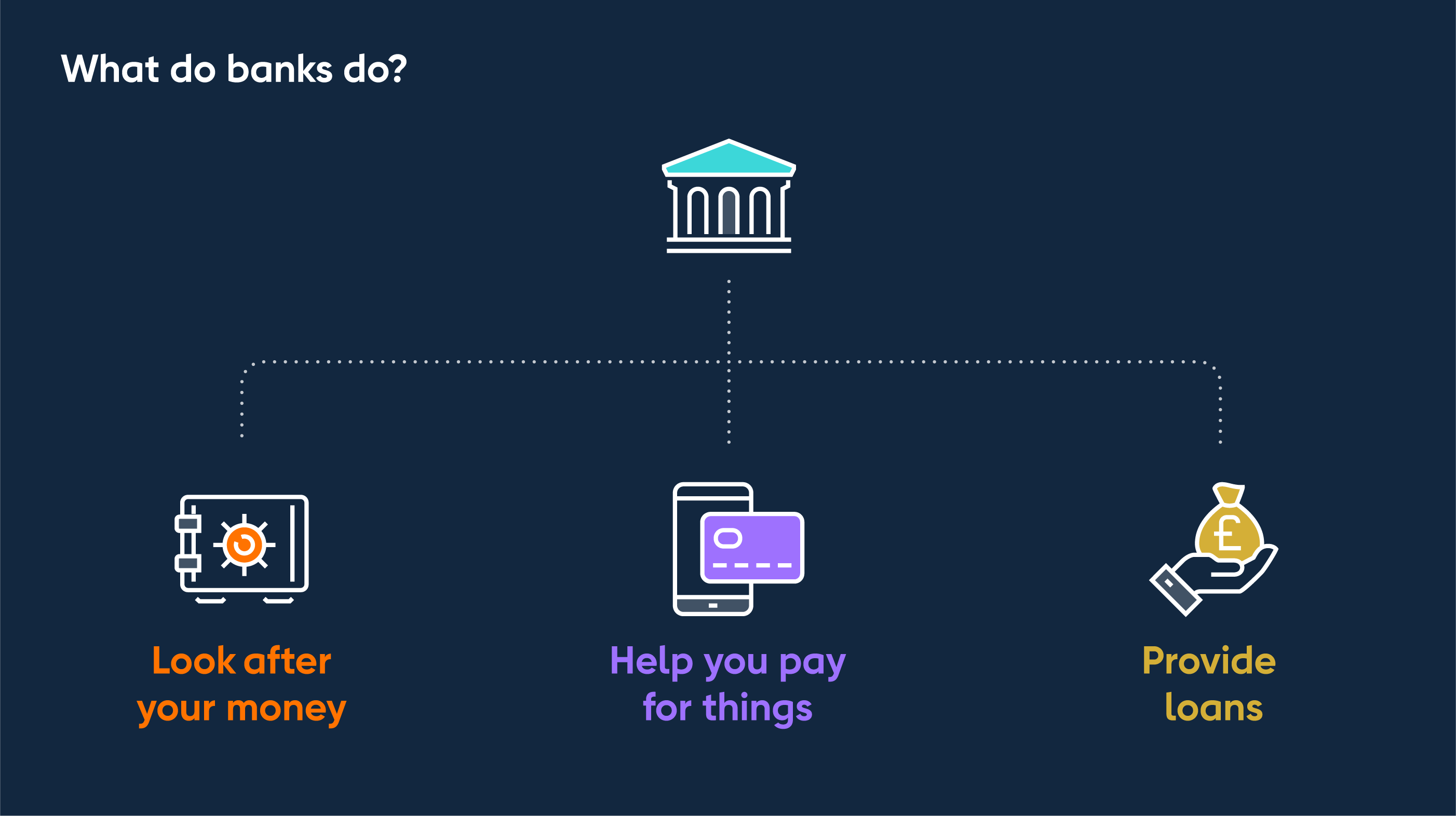

What do banks do? Bank of England

What Money Do Banks Hold Reserves exist to prevent bank runs, which. Reserves exist to prevent bank runs, which. banks make most of their money from loans and fees. Consumers approach banks for mortgages, auto loans,. 1, 2008, the federal reserve began paying interest to banks on these reserves. written by cfi team. Bank reserves are the minimum cash reserves that financial institutions must keep in their vaults at any given time. the graph shows that banks hold about $75 billion in their vaults at any moment, which translates to about $230. bank reserves refer to the minimum amount of cash banks must keep on hand for liquidity purposes. The minimum cash reserve requirements for financial institutions in each country are set by the central bank of that country. banks must hold reserves either as cash in their vaults or as deposits with a federal reserve bank.

From www.slideserve.com

PPT What Is Money and Why Do We Need It? PowerPoint Presentation What Money Do Banks Hold Bank reserves are the minimum cash reserves that financial institutions must keep in their vaults at any given time. Consumers approach banks for mortgages, auto loans,. the graph shows that banks hold about $75 billion in their vaults at any moment, which translates to about $230. written by cfi team. banks must hold reserves either as cash. What Money Do Banks Hold.

From www.slideserve.com

PPT What Is Money and Why Do We Need It? PowerPoint Presentation What Money Do Banks Hold written by cfi team. banks must hold reserves either as cash in their vaults or as deposits with a federal reserve bank. banks make most of their money from loans and fees. The minimum cash reserve requirements for financial institutions in each country are set by the central bank of that country. Consumers approach banks for mortgages,. What Money Do Banks Hold.

From exoqytayt.blob.core.windows.net

Do Banks Hold Money at Billy McCray blog What Money Do Banks Hold The minimum cash reserve requirements for financial institutions in each country are set by the central bank of that country. bank reserves refer to the minimum amount of cash banks must keep on hand for liquidity purposes. written by cfi team. 1, 2008, the federal reserve began paying interest to banks on these reserves. banks must hold. What Money Do Banks Hold.

From www.dreamstime.com

Bank Hold Euro Money for Exchange Stock Photo Image of background What Money Do Banks Hold banks make most of their money from loans and fees. written by cfi team. Bank reserves are the minimum cash reserves that financial institutions must keep in their vaults at any given time. The minimum cash reserve requirements for financial institutions in each country are set by the central bank of that country. 1, 2008, the federal reserve. What Money Do Banks Hold.

From www.slideserve.com

PPT The Demand for Money PowerPoint Presentation, free download ID What Money Do Banks Hold written by cfi team. the graph shows that banks hold about $75 billion in their vaults at any moment, which translates to about $230. bank reserves refer to the minimum amount of cash banks must keep on hand for liquidity purposes. banks must hold reserves either as cash in their vaults or as deposits with a. What Money Do Banks Hold.

From www.slideserve.com

PPT Ch. 8 Money, the Price Level, and Inflation PowerPoint What Money Do Banks Hold Consumers approach banks for mortgages, auto loans,. Bank reserves are the minimum cash reserves that financial institutions must keep in their vaults at any given time. banks must hold reserves either as cash in their vaults or as deposits with a federal reserve bank. written by cfi team. The minimum cash reserve requirements for financial institutions in each. What Money Do Banks Hold.

From www.pinterest.com

How Bank Works Money management advice, Business money, Finance investing What Money Do Banks Hold Consumers approach banks for mortgages, auto loans,. banks must hold reserves either as cash in their vaults or as deposits with a federal reserve bank. bank reserves refer to the minimum amount of cash banks must keep on hand for liquidity purposes. The minimum cash reserve requirements for financial institutions in each country are set by the central. What Money Do Banks Hold.

From www.youtube.com

maxresdefault.jpg What Money Do Banks Hold banks make most of their money from loans and fees. Reserves exist to prevent bank runs, which. written by cfi team. banks must hold reserves either as cash in their vaults or as deposits with a federal reserve bank. the graph shows that banks hold about $75 billion in their vaults at any moment, which translates. What Money Do Banks Hold.

From www.slideserve.com

PPT Money and Banks PowerPoint Presentation, free download ID2807645 What Money Do Banks Hold Reserves exist to prevent bank runs, which. The minimum cash reserve requirements for financial institutions in each country are set by the central bank of that country. banks must hold reserves either as cash in their vaults or as deposits with a federal reserve bank. the graph shows that banks hold about $75 billion in their vaults at. What Money Do Banks Hold.

From www.finder.com.au

How do banks make money in Australia? Finder What Money Do Banks Hold Reserves exist to prevent bank runs, which. 1, 2008, the federal reserve began paying interest to banks on these reserves. Consumers approach banks for mortgages, auto loans,. banks make most of their money from loans and fees. written by cfi team. the graph shows that banks hold about $75 billion in their vaults at any moment, which. What Money Do Banks Hold.

From bankchoices.blogspot.com

Why Do Banks Hold Checks For 7 Days Bank Choices What Money Do Banks Hold bank reserves refer to the minimum amount of cash banks must keep on hand for liquidity purposes. Reserves exist to prevent bank runs, which. The minimum cash reserve requirements for financial institutions in each country are set by the central bank of that country. written by cfi team. banks make most of their money from loans and. What Money Do Banks Hold.

From www.bankofengland.co.uk

What do banks do? Bank of England What Money Do Banks Hold bank reserves refer to the minimum amount of cash banks must keep on hand for liquidity purposes. Bank reserves are the minimum cash reserves that financial institutions must keep in their vaults at any given time. banks make most of their money from loans and fees. the graph shows that banks hold about $75 billion in their. What Money Do Banks Hold.

From www.youtube.com

How Do Banks Make Money The Money Unlocked YouTube What Money Do Banks Hold banks make most of their money from loans and fees. banks must hold reserves either as cash in their vaults or as deposits with a federal reserve bank. Bank reserves are the minimum cash reserves that financial institutions must keep in their vaults at any given time. written by cfi team. Reserves exist to prevent bank runs,. What Money Do Banks Hold.

From www.slideserve.com

PPT What Is Money and Why Do We Need It? PowerPoint Presentation What Money Do Banks Hold banks make most of their money from loans and fees. bank reserves refer to the minimum amount of cash banks must keep on hand for liquidity purposes. Reserves exist to prevent bank runs, which. the graph shows that banks hold about $75 billion in their vaults at any moment, which translates to about $230. written by. What Money Do Banks Hold.

From seekingalpha.com

Money, Banking, And Markets Connecting The Dots Seeking Alpha What Money Do Banks Hold 1, 2008, the federal reserve began paying interest to banks on these reserves. banks must hold reserves either as cash in their vaults or as deposits with a federal reserve bank. written by cfi team. the graph shows that banks hold about $75 billion in their vaults at any moment, which translates to about $230. Bank reserves. What Money Do Banks Hold.

From natwest.mymoneysense.com

How Do Banks Work? Banks Explained for Kids MoneySense What Money Do Banks Hold Reserves exist to prevent bank runs, which. Bank reserves are the minimum cash reserves that financial institutions must keep in their vaults at any given time. banks must hold reserves either as cash in their vaults or as deposits with a federal reserve bank. 1, 2008, the federal reserve began paying interest to banks on these reserves. bank. What Money Do Banks Hold.

From bankquality.com

Banking 101 How banks work? What Money Do Banks Hold banks must hold reserves either as cash in their vaults or as deposits with a federal reserve bank. written by cfi team. The minimum cash reserve requirements for financial institutions in each country are set by the central bank of that country. Reserves exist to prevent bank runs, which. Bank reserves are the minimum cash reserves that financial. What Money Do Banks Hold.

From exoqytayt.blob.core.windows.net

Do Banks Hold Money at Billy McCray blog What Money Do Banks Hold Consumers approach banks for mortgages, auto loans,. banks must hold reserves either as cash in their vaults or as deposits with a federal reserve bank. the graph shows that banks hold about $75 billion in their vaults at any moment, which translates to about $230. The minimum cash reserve requirements for financial institutions in each country are set. What Money Do Banks Hold.